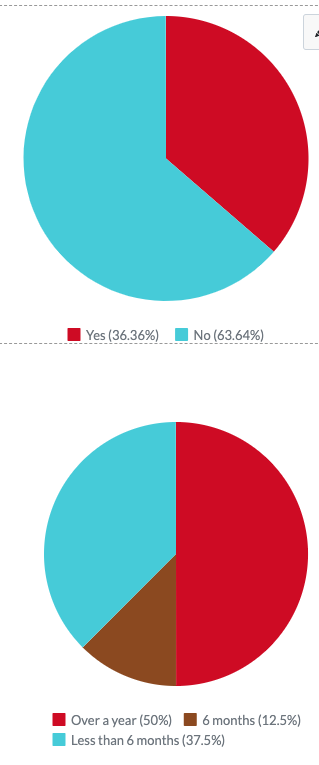

Recently, the NBA team the Sacramento Kings made news when they offered to pay player salaries in bitcoin. News like this has legitimized bitcoin and other cryptocurrencies as perhaps something more than a fad. In a May survey of 24 seniors, 41.7% of students said they have invested in cryptocurrencies such as Bitcoin, Dogecoin, and Euthereum.

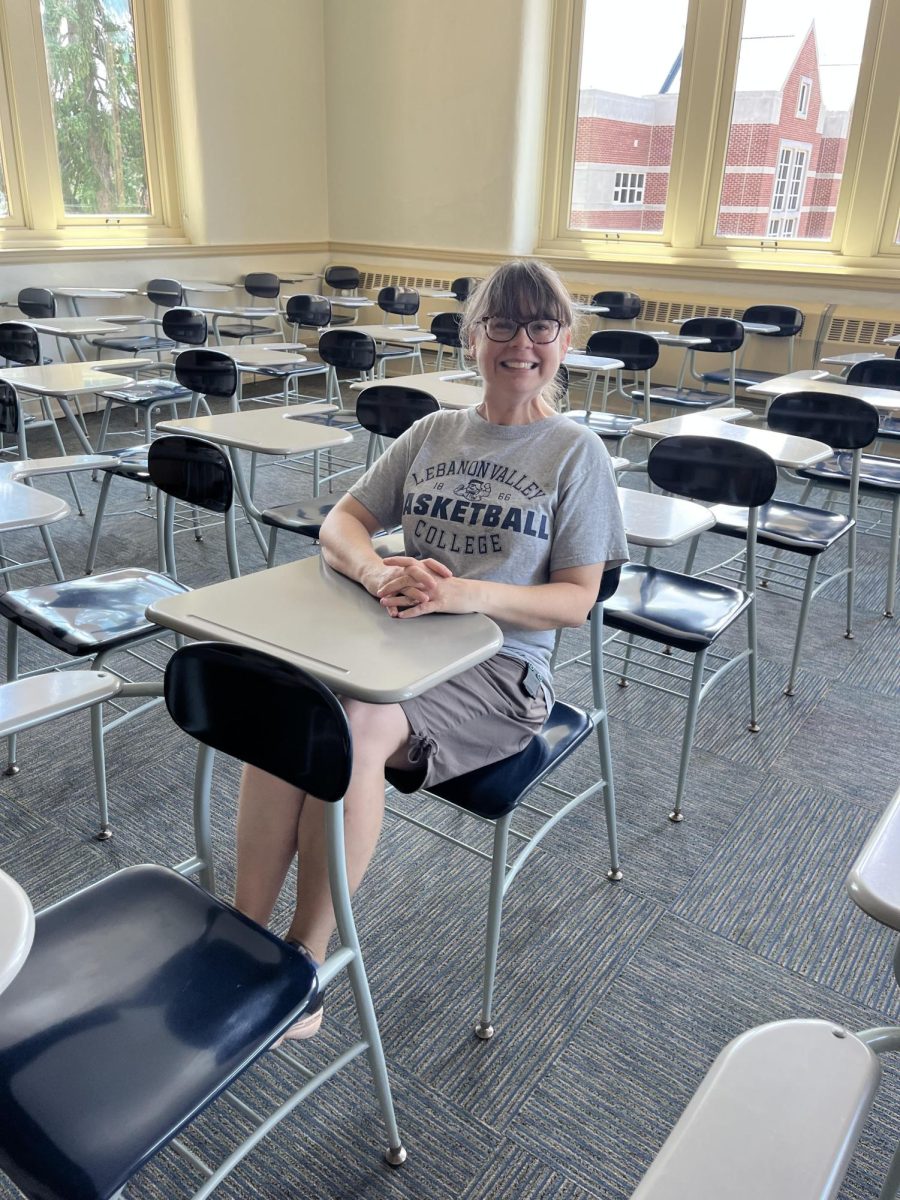

Social Science teacher Kelly Aull said such investments — fad or not — teach valuable lessons.

“Investments like [cryptocurrencies] require saving first, plus delayed gratification. These are good things for students in terms of long-term goal setting,” Aull said.

As the economics teacher at Trinity, Aull teaches about the importance of investing. Aull views making investments in cryptocurrencies as a good start to help student investors learn more about how to save and invest their money.

“Right now, bitcoin is a volatile investment,” Aull said. “This means that investors can stand to make money by holding bitcoin, but that potential reward comes with the risk of losing your whole investment. For students who want to give investing a try, and don’t necessarily need to hang onto their savings, bitcoin and other investments of similar risk can be a fun way to get started.”

According to Yahoo Finance, 14% of Americans own a cryptocurrency like Bitcoin or Ethereum. Coinbase has recently passed over 56 million users and as cryptocurrency continues to rise, the percentage of people investing and buying will likely also rise.

“I think anything that helps people make secure, fast financial transactions can be good for the economy,” Aull said.

Social Science teacher Benjamin Gaddis said the Coronavirus pandemic and mistrust in banking are two big reasons that led to this moment.

“I think it’s an interesting time for currency and finances around the world,” Gaddis said. “I think we will really see where cryptocurrency goes, and it becomes legitimate when a country anywhere in the world finally accepts it as a form of paying taxes.”

Aull said bitcoin has a lot of potential, but it’s just not widely used enough yet for us to talk about it as a competing monetary system or even an online payment platform for everyday use. She added on to this with how she thinks bitcoin could change.

“Once more and more companies start accepting bitcoin, and more of your average consumers acquire it, I think bitcoin will start to look a lot like PayPal or Venmo or ApplePay,” Aull said.

Gaddis added how he thinks bitcoin will look in the future.

“Given that the IRS on the tax form this year asked if you invested or made money off of Bitcoin, I could see potentially in the future years that maybe the United States will be the first to start taxing profits on bitcoin much like they would share in the stock market,” Gaddis said. “The second they do that, it will legitimize Bitcoin and really blow it up.”

As these different cryptocurrencies grow in popularity, people start better understanding how they work and how exactly to use and invest in them.

One of the biggest questions about the cryptocurrency market is how long it will last. Aull predicts bitcoin will become increasingly popular because of the increase in online purchasing, the steady increase in the public’s knowledge about cryptocurrency and the improvements in blockchain technology that help maintain bitcoin.

“There are three paths ahead of us: bitcoin can stay as it is now, it can become more popular and universally accepted, or it can fade into disuse,” Aull said.