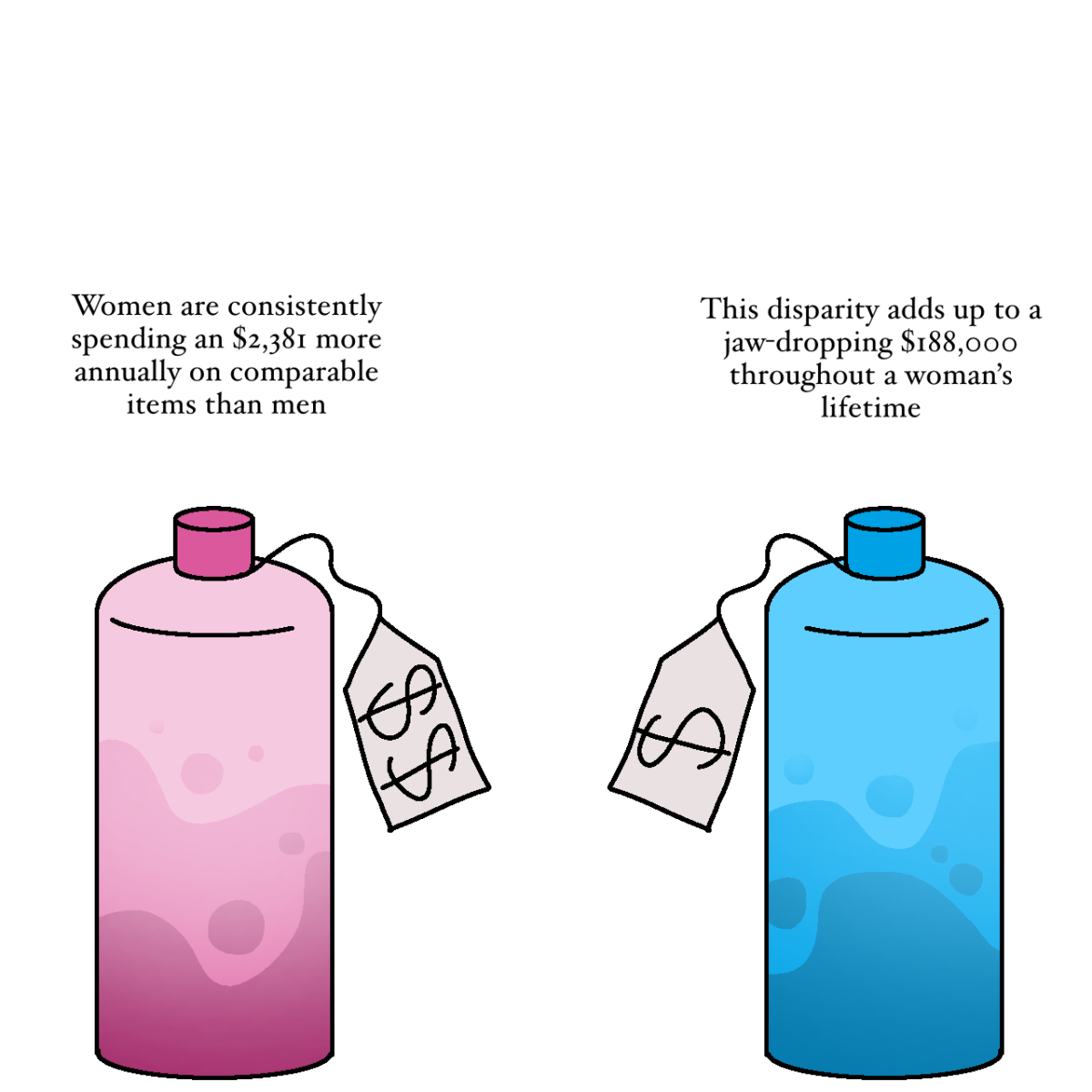

In a groundbreaking study conducted in 2020, researchers unveiled a startling revelation: women are consistently spending an average of $2,381 more annually on comparable items than their male counterparts. This staggering disparity adds up to a jaw-dropping $188,000 throughout a woman’s lifetime. This financial imbalance, referred to as the “pink tax,” continues to underscore the sexism embedded within modern society.

The “pink tax” phenomenon is characterized by the inflation of prices for products marketed toward women compared to similar products marketed toward men. This discrepancy is not a direct government-imposed tax but rather a reflection of discriminatory pricing practices prevalent in the consumer market. Furthermore, the pink tax extends beyond tangible goods to include services, where women often encounter inflated costs solely based on their gender.

The tampon tax specifically targets menstrual products, subjecting them to sales tax while exempting many other essential items. Too often, period products are taxed as luxury items and not recognized as necessities. Period products are taxed at a similar rate to items like decor, electronics, makeup, and toys.

“The tampon tax is really annoying because it’s essentially taxing women for a biological necessity,” says Ellison Clark, a sophomore at Trinity Prep. “Menstrual products are not optional, but they’re treated as luxury items in some places, which is totally unfair.”

In a recent development, California became the latest state to eliminate the tampon tax, joining 22 other states that have exempted menstrual products from sales tax. As some states begin to acknowledge the issue, the pink tax and tampon tax continue to persist in 27 states and continue using discriminatory pricing practices against women.

Women often find themselves bearing the brunt of these pricing inequities, as they are forced to pay more for everyday items like razors, shampoo, and clothing. Additionally, it reinforces gender stereotypes, perpetuating the idea that women should pay more for products simply because of their gender.

“Examples of gender-based price disparities for goods and services have been documented throughout the economy,” noted a December 2016 report by the Joint Economic Committee of the United States Congress. “This phenomenon may not constitute intentional gender discrimination. Yet the frequency with which female consumers find themselves paying higher prices for gender-specific goods and services effectively becomes a tax on being a woman.”

While some claim that price differences result from manufacturing or marketing costs, the main problem persists: women regularly pay more due to their gender. This continues economic inequality, reducing women’s purchasing power and straining their finances compared to men. Additionally, the pink tax and tampon tax spark discussions about sexism and gender bias, showing how these prejudices affect everyday purchases.

Beyond their financial implications, the pink tax and tampon tax also reflect deeper societal issues. They highlight the normalization of gender discrimination in consumer markets, where women are routinely charged more for products that are essential to their daily lives. This sends a troubling message about the value placed on women’s needs and experiences in society.

The pink tax and tampon tax are rooted in gender biases ingrained in cultural and societal norms. Girls are taught from a young age to focus on appearance and personal care, resulting in higher spending on products marketed to women throughout their lives. This reinforces stereotypes and maintains unequal power dynamics between genders.